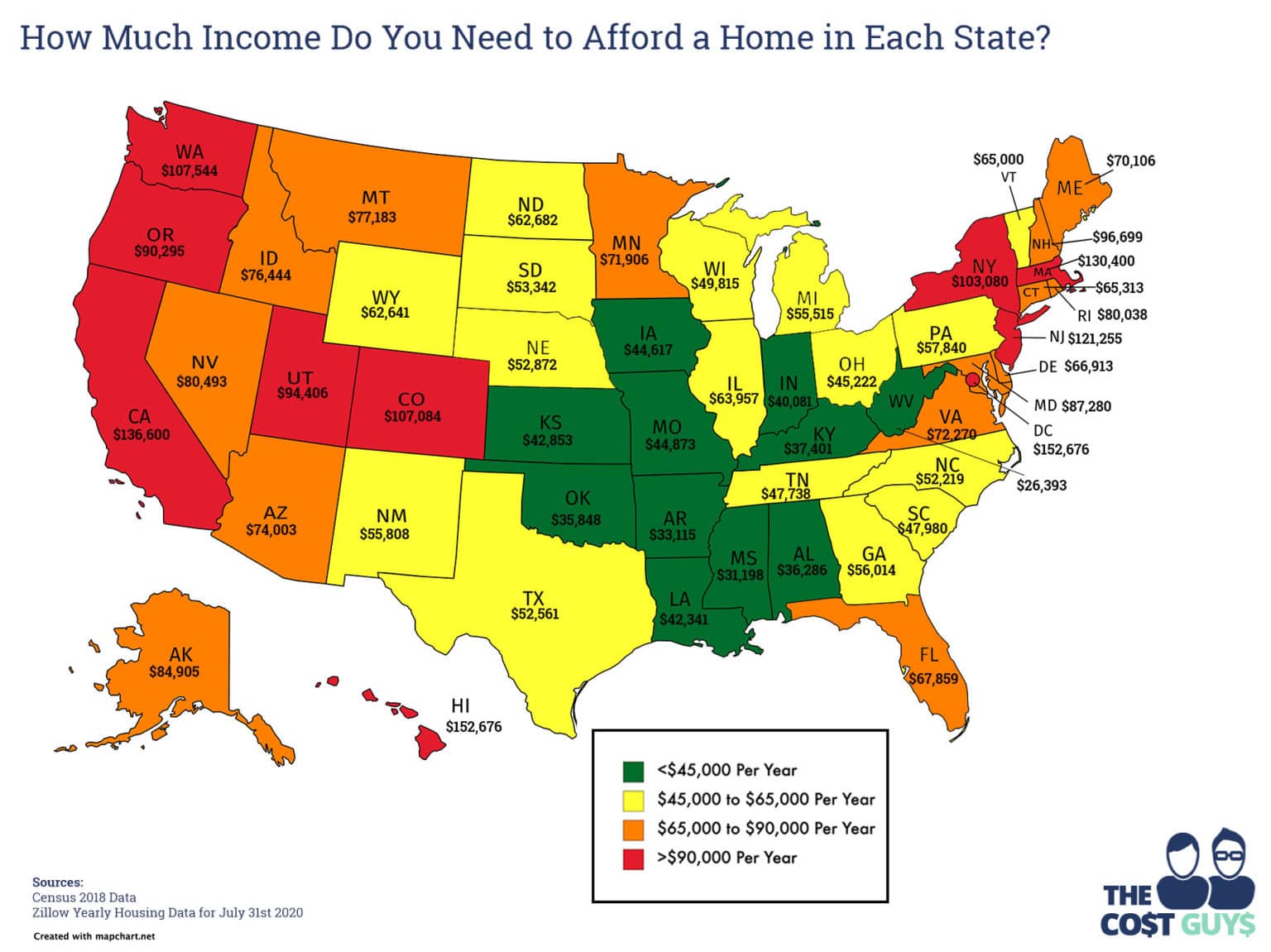

Although there may be differing opinions when it comes to buying a home, most people will eventually take the plunge. These things tend to run in trends, and millennials are now up to bat when it comes to getting married, having children, and settling into a house. In the end, most people consider it to be a financial decision and affording a house can be difficult for some families.

As it turns out, buying a house may just be easier in some states when you compare it to buying a house in others.

The Cost Guys reports on a study that West Virginians can become homeowners if they only earn $26,393 annually. That is the lowest state in the United States. Generally speaking, living in the south, the Midwest, and Appalachia is typically good when it comes to owning your own home. For those with salaries below $40,000 in Alabama, Arkansas, Kentucky, Mississippi, and Oklahoma, the possibility of owning a home is also quite good.

However, if you live in Hawaii, you may just want to consider renting for the long-term. An average annual salary of $152,676 or more is necessary if you want to comfortably purchase a home. In California, the annual salary needed is at least $136,600 and for in Colorado, Washington, New Jersey, Massachusetts, and Washington, D.C, be sure to earn at least $100,000 before taking the plunge.

The Cost Guys used a common figure of 30% of your annual earnings being put toward your home to arrive at these numbers. Those figures would include mortgage, insurance, property tax, and down payment. They also used Zillow to calculate median real estate values.

Some people are going to be thrilled with these numbers and others are going to be disappointed. Don’t be overly concerned, because there is always the possibility of purchasing a home at a lower price than the state median value. You may also be able to pay a lower down payment or perhaps budget more than 30% for housing costs.