Charlie Ehlers is a young stock investor who has already managed to amass a small fortune by the age of 28.

Of course, there are lots of people who want to know how he has managed to accomplish this goal. He does not mind sharing all of his knowledge but there are plenty who want to know more about some of the ideas that he is sharing with his audience.

“Here are some money rules I follow as someone in my 20s who has been investing for 10 years now,” Ehlers shares on TikTok. Clothes, alcohol and food delivery are just a few of the areas that he targeted.

The advice that he had to offer about designer clothing is sure to resonate with anyone who has blown more than they would like at places like Gucci and Louis Vuitton. “[Don’t buy] designer clothing brands and labels,” he advises, going to say that the aforementioned high fashion staples “specifically target broke people who want to look rich.”

Alcohol and services like DoorDash were also targeted by Charlie. “If you’re someone who will go out and spend $150 to $200 on drinks but you complain about fuel prices and rent prices and interest rates, you’re idiotic,” he says.

He encourages those who are looking to head out to have a few drinks ahead of time. The cost of alcohol dwindles significantly when you are already buzzed by the time you hit the bar. These are all simple tips but as he warns the viewer, the pointers were about to get far more controversial.

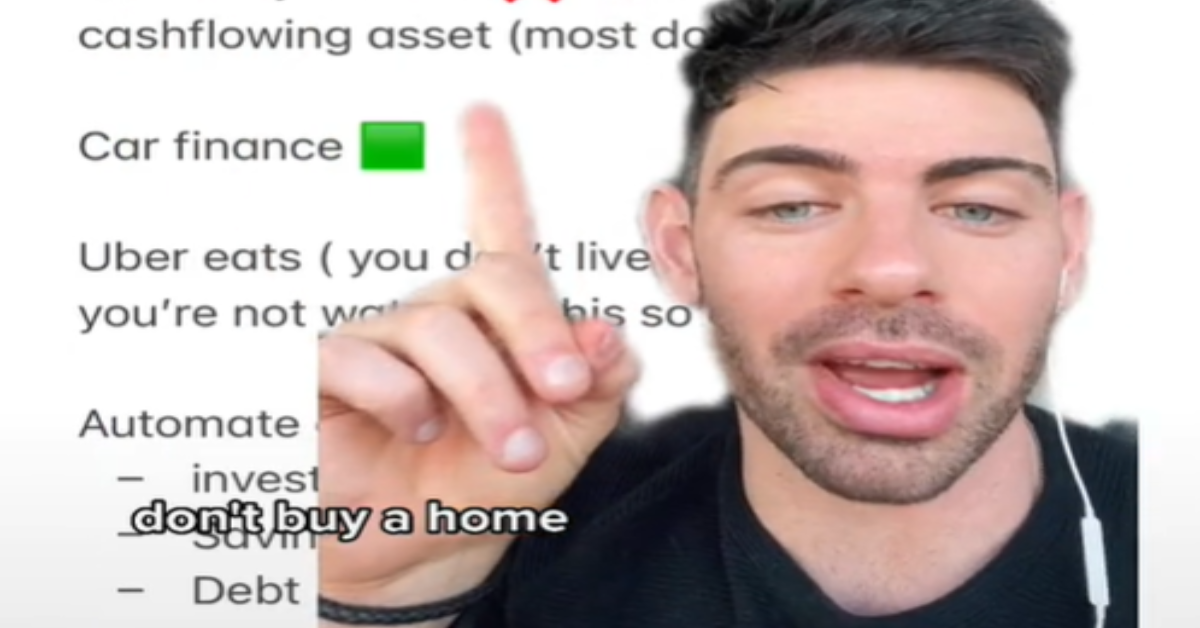

“Too many people go into debt to get a degree that they don’t use,” he offers. “If you’re getting a degree, [only] do it because you want to be in that profession.” Beyond that, he also advised young viewers against the prospect of home ownership. It may be controversial to some but the advice that he has to offer here makes a lot of sense to us.

“Don’t buy a home,” Charlie says. He adds that it’s only a good idea if you plan to use the home to become a cash-flowing asset, rather than a liability. Unless you’ve sat down and gone through all the numbers of what it costs to run and own a home, you’re not allowed to comment on that point.

To find out more about his tips (and the importance of investing in quality bedding), please be sure to check out this clip. His pointers are sure to resonate with any young person who is looking to make a dollar stretch.

@charlieehlers Check out my free $ guide ➡️ #personalfinance #investing #moneyrules